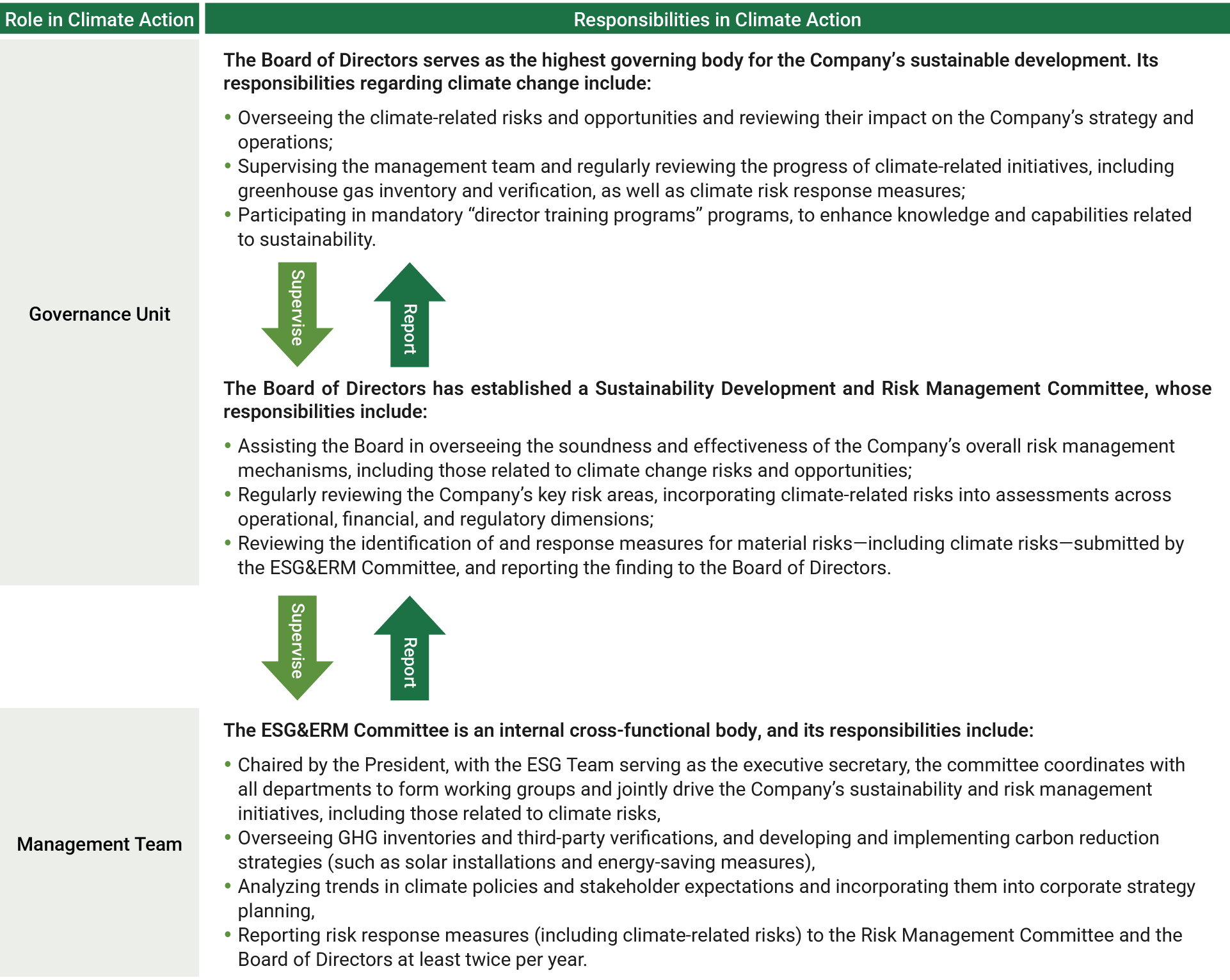

Oneness Biotech recognizes the enormous impact of climate change on the economy, society, and the environment. As one of the leading biotech pharmaceutical companies in Taiwan, we must heed our corporate social responsibility and respond to the challenges brought forth by climate change. In 2023, the Oneness Biotech Sustainability Development and Risk Management Committee identified climate change as one of the potential risks. To measure and analyze the impact of climate-related risks and to formulate control measures, we adopted the framework from the Task Force on Climate-related Financial Disclosure (TCFD) issued by the Financial Stability Board (FSB). Based on the framework, we disclosed our governance, strategies, risk management and metrics, and targets to help investors and stakeholders understand Oneness Biotech’s climate actions.

The ESG Committee reported the progress and result of sustainable development and risk management to the Board of Directors on February 27, August 8, and November 10, 2025. The Board of Directors supervised the progress of the implementation of sustainable development matters, including GHG inventory and the verification program.

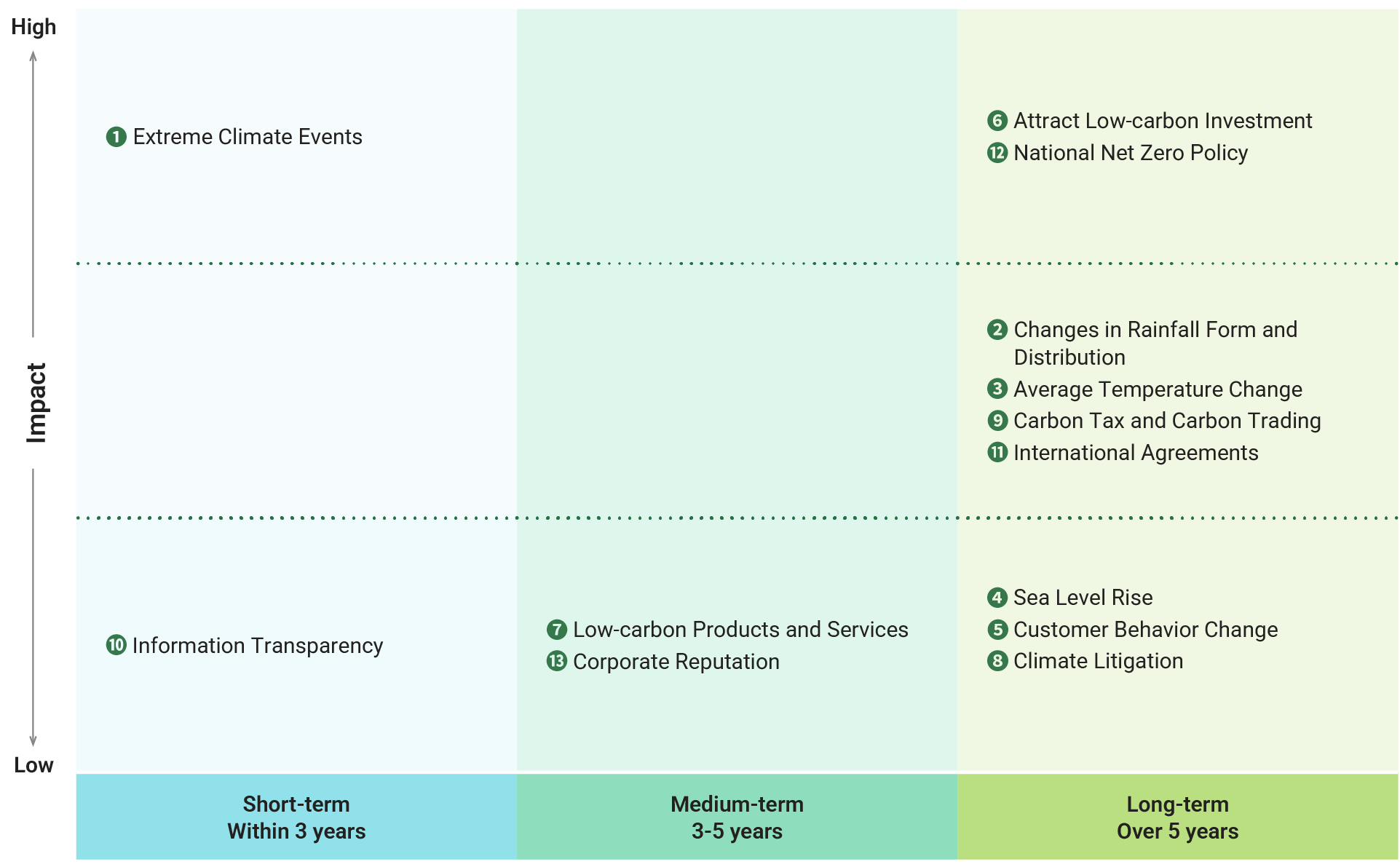

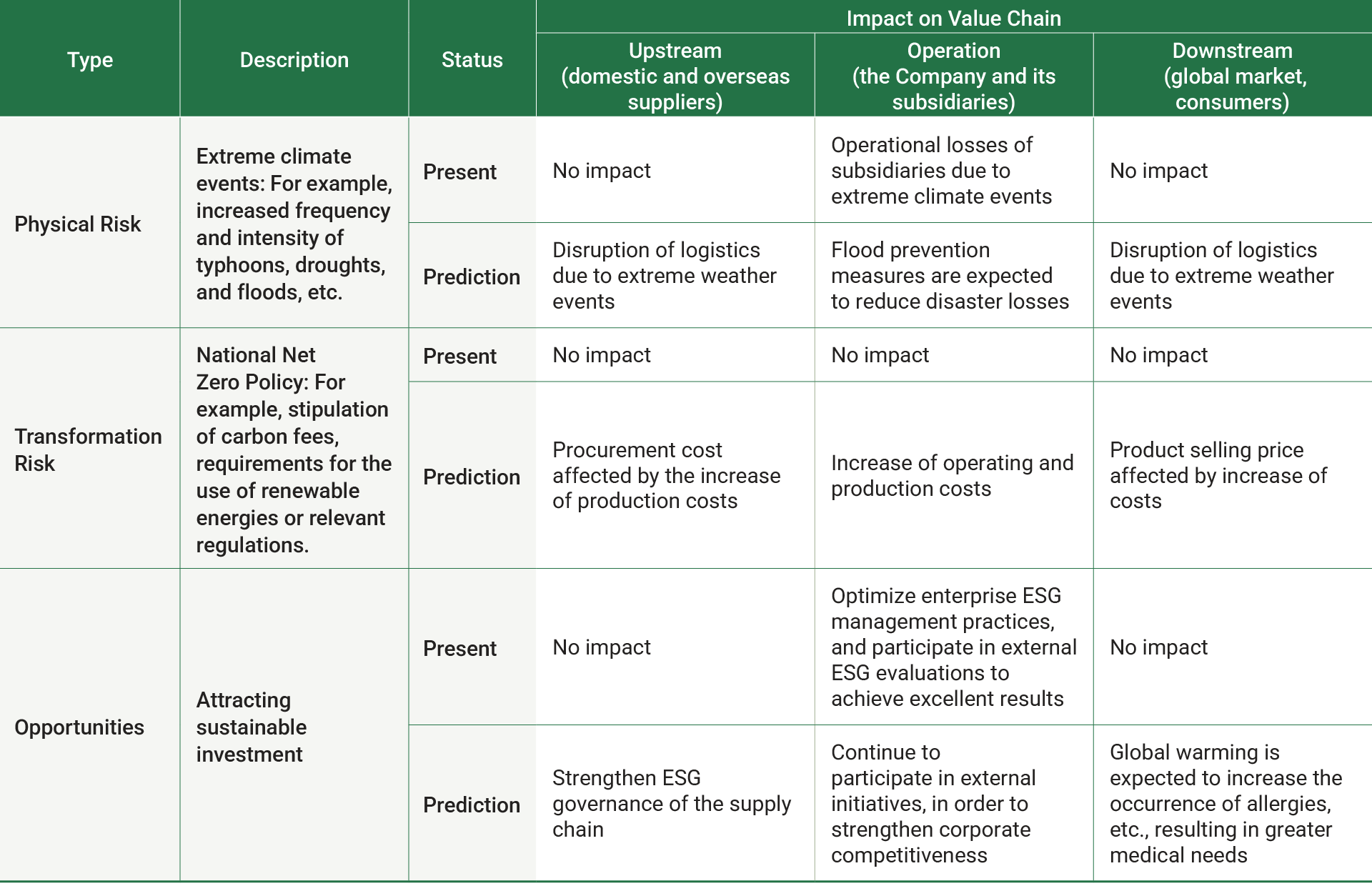

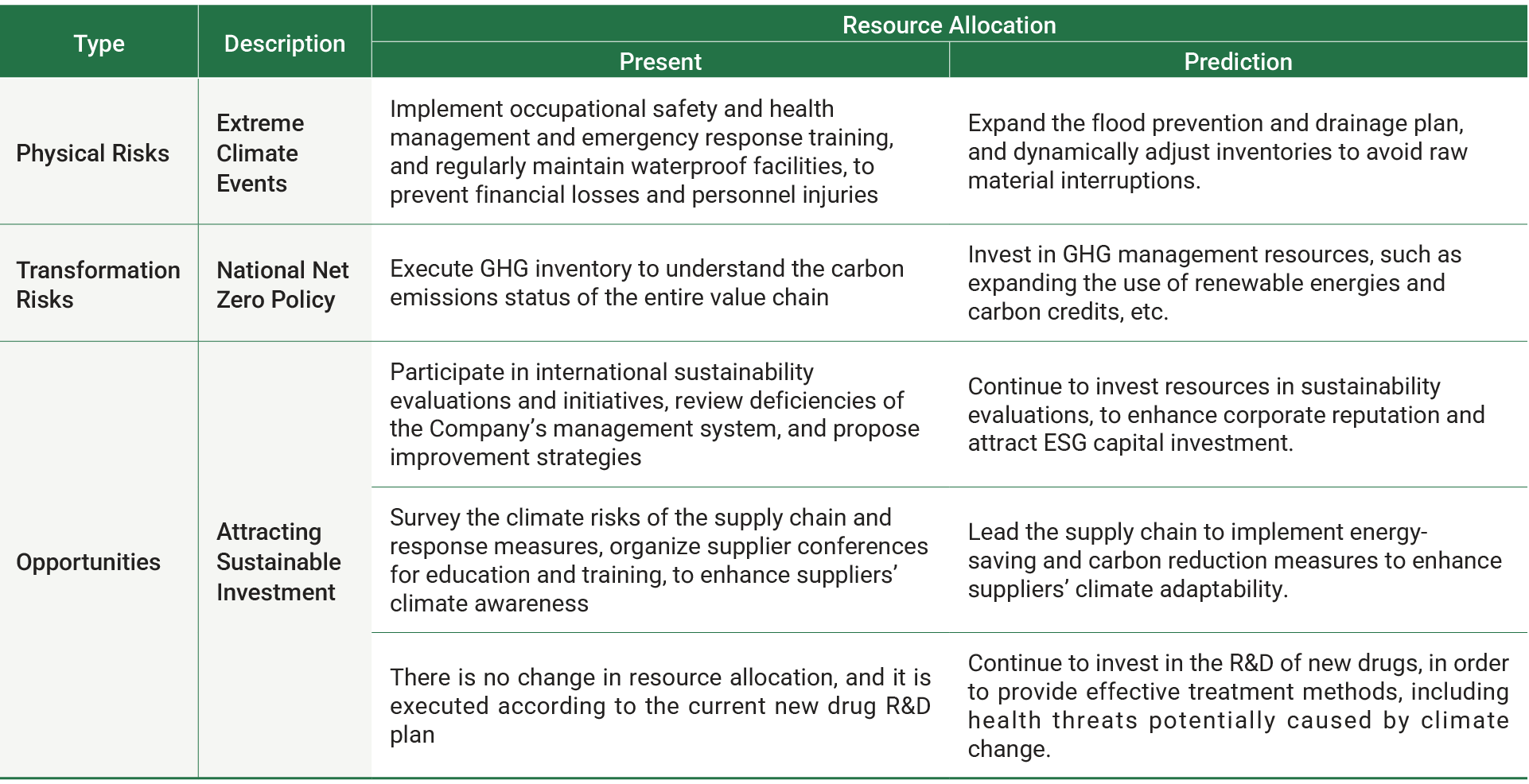

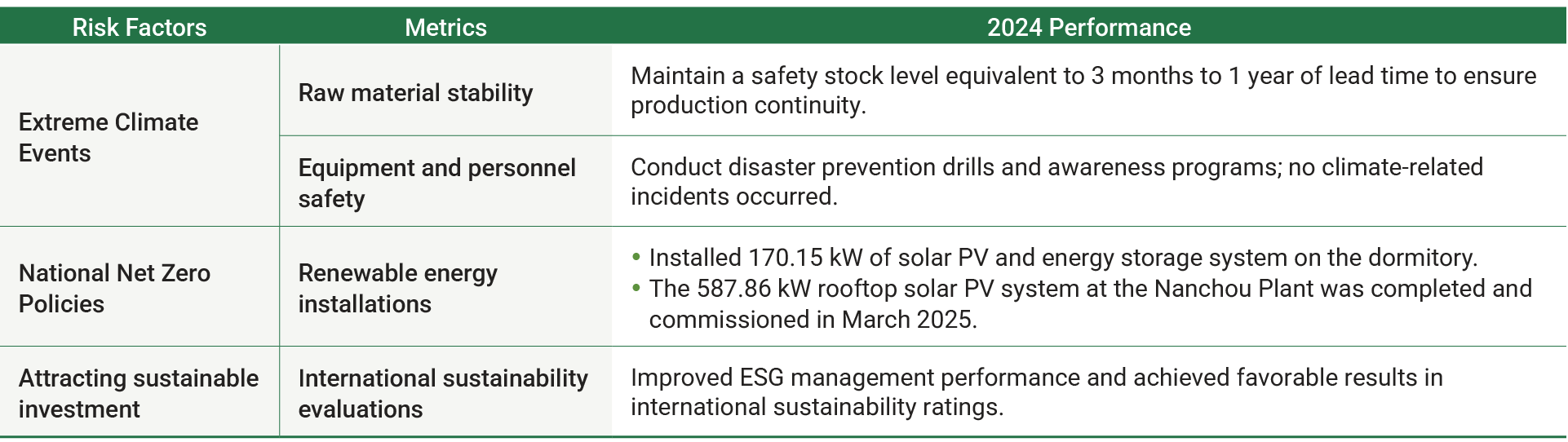

The Company reviews domestic and international climate-related issues and industry development trends to identify potential risks – including physical and transition risks– and opportunities. Through a series of workshops involving dedicated personnel and senior management from various departments, and in close collaboration with external third-party experts, we conducted in-depth discussions. Reasonable and verifiable data were used—such as participants’ academic and industry experience, historical incidents, and forward-looking projections—to assess both the severity of impact and the urgency of potential risk events. As a result, the Company has identified the following significant climate-related risks and opportunities: extreme weather events, the ability to attract sustainable investment, and national net-zero policies.

The responsible unit identifies relevant risk factors, analyzes the potential impact of each risk on the Company’s operations, and develops and adopts measures to control risks within the Company’s acceptable range. The Sustainability Development and Risk Management Committee receives regular reports from the Risk Management Task Force and supervises the status of risk management execution by the Company and its important subsidiaries. At the meeting of the Sustainability Development and Risk Management Committee in 2024, the risks related to extreme climate were monitored with relevant countermeasures formulated, including, raw material inventories and future production capacity responses.

The Company has introduced an Internal Carbon Pricing (ICP) mechanism with the purpose of concretizing and monetizing carbon emissions, thereby embedding them into daily operations and long-term strategic planning to accelerate our transition toward a low-carbon business model. Please refer to the relevant details for further information.

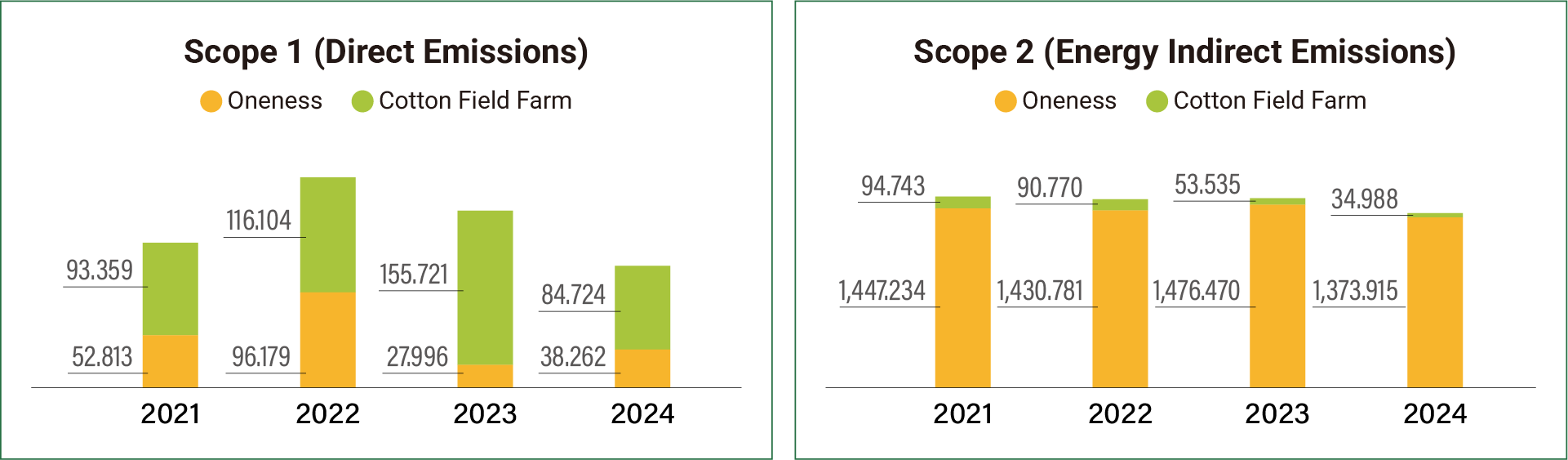

Based on the Tier 1 method described in Chapter 5 “Cropland Management” of Volume 4 of the “2019 Refinement to the 2006 IPCC Guidelines for National Greenhouse Gas Inventories”, the average annual increase/decrease in emissions for a period of 20 years of the traditional farming method before lease and the organic farming method after lease is estimated. Since March 2017, the Cotton Field Organic Farm has exclusively employed organic farming methods. The organic certification area of Cotton Field Organic Farm is 32.4679 hectares, and the annual absorption of approximately 86.953 (tCO2e).

※The above content is taken from the ESG Report